Selecting the right payroll software is key for small business operations. The primary goal is to reduce errors, save time, and ensure compliance with tax regulations. Several software solutions cater specifically to small businesses, offering features such as time tracking, tax calculations, direct deposits, and employee self-service portals. Payroll software allows small businesses to streamline payroll processing and administrative tasks without the need for extensive manual input or additional systems.

Homebase: Efficient for Hourly Teams

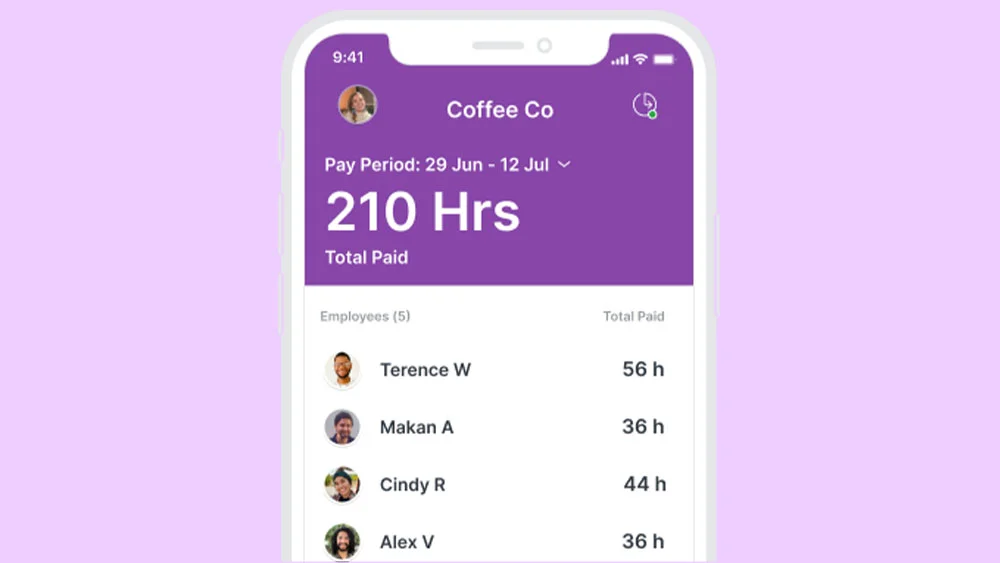

Homebase is designed particularly for businesses that rely on hourly wage workers. Its strength lies in converting timesheets directly into wages and taxes, in addition to generating paychecks or arranging direct deposits. Homebase simplifies federal, state, and local tax calculations, a major function for businesses that need to ensure their tax filings are accurate. Platforms like Homebase also simplify the generation of essential business tax forms, ensuring compliance with local and federal regulations. This feature enables business owners to keep up with varying tax requirements without extensive manual intervention.

Aside from basic payroll operations, Homebase comes equipped with time and attendance tracking functionalities. This includes managing overtime and time off, offering a comprehensive solution for businesses where working hours can vary. Employee self-onboarding, payroll forms, and self-service capabilities further enhance the platform’s appeal. These features allow employees to handle their own tax filings, paychecks, and other related paperwork, ensuring a smoother payroll process.

Homebase also includes team messaging, scheduling, and labor cost management tools, which are all especially useful for small businesses with dispersed teams or those operating multiple locations. With payroll running at a fixed rate of $39 a month plus $6 for each active employee, the platform provides unlimited payroll capabilities, making it a cost-effective choice for many small operations. More than 100,000 small businesses already rely on Homebase, further showcasing its effectiveness in this market.

Gusto: Comprehensive but User-Friendly

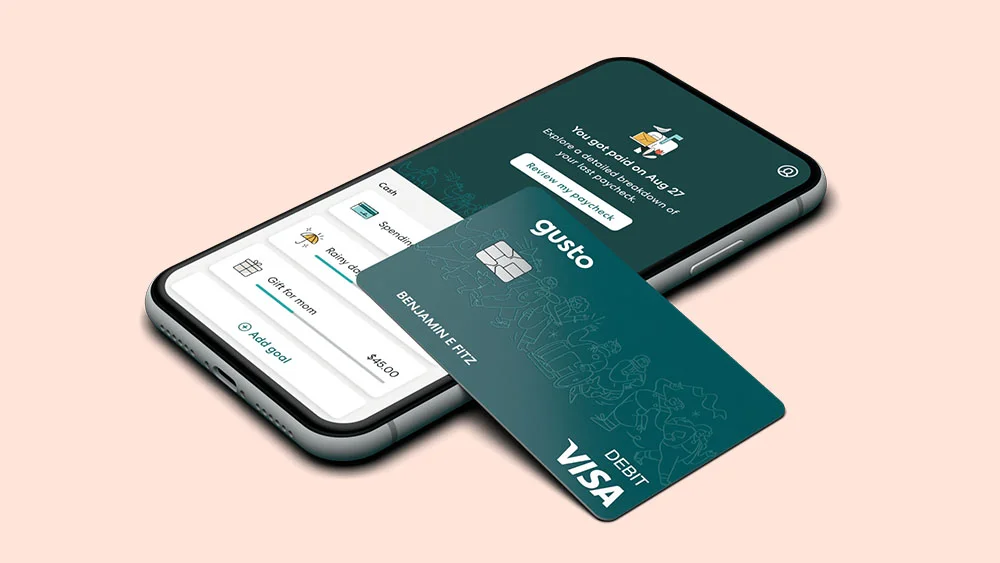

Gusto is designed primarily for small to medium-sized businesses, with an interface that is intuitive and easy to use. It automates payroll while handling both federal and local tax compliance efficiently. It offers direct deposits and paycheck generation while also tracking time and attendance. These automatic processes help ensure accurate payroll calculations.

Furthermore, Gusto integrates employee benefits into payroll management, providing tools for workers to access retirement plans, health insurance, and more. The platform also includes satisfaction surveys to help small businesses with employee feedback, creating additional dimensions for management beyond payroll processing.

Despite its user-friendly nature, Gusto has been critiqued for its somewhat slow customer support. The platform may also struggle to meet the growing needs of larger organizations as their employee base expands. Additionally, those needing immediate technical support might find themselves waiting longer than expected for a resolution. Still, for small businesses looking for simple, feature-rich payroll software, Gusto remains an attractive option.

Paychex and OnPay: Tailored to Industry-Specific Needs

Paychex offers a modular structure, with businesses able to select subscription levels suited to their exact requirements. For instance, Paychex’s payroll services include tax management tools and wage garnishment options. This ability to manage complex scenarios makes it particularly suited for businesses operating in industries where payroll needs vary beyond the basics, such as construction or healthcare. However, with its tiered pricing model, Paychex may pose a financial burden for very small businesses. Feedback on customer service also varies. Some users report prompt service, while others highlight its inconsistency, especially for smaller accounts.

OnPay is increasingly recognized as one of the more affordable options, offering a flat pricing structure with extensive features. Ideal for restaurant owners, its software includes tools for calculating tips, managing overtime, and adhering to industry-specific wage requirements. OnPay’s unlimited payroll runs, combined with payroll tax management and detailed reporting, provide valuable tools for small businesses where payroll compliance goes beyond the norm. The platform also integrates well with HR functions, helping businesses handle the entire employee journey from hiring to payroll.

Both Paychex and OnPay provide solutions tailored to unique operational needs, which is especially useful for small businesses in niche industries. While Paychex may be a stronger option for those requiring high customization, OnPay provides a similarly robust yet more affordable alternative.

QuickBooks Payroll and ADP: Integration and Scalability

QuickBooks Payroll efficiently incorporates itself into an existing workflow by integrating with the QuickBooks accounting suite. This merger allows businesses to combine their financial management with payroll processing. The software oversees employee data management and automatically calculates payroll based on recorded time and attendance, ensuring minimal errors. Additionally, QuickBooks Payroll uses direct deposits for accurate, timely payments, avoiding wage delays.

Despite these benefits, the software’s higher price points might be prohibitive for smaller businesses not already deeply engaged in the QuickBooks ecosystem. For businesses without extensive accounting needs, this level of financial management may be unnecessary. Still, QuickBooks remains a valuable tool for those seeking a single platform to manage both payroll and bookkeeping.

ADP, meanwhile, is designed to scale effectively with businesses of varying sizes. Handling everything from employee data and automated timekeeping to tax calculations, ADP remains one of the more comprehensive payroll services available. However, the software encounters the same caveat as Paychex: its suitability and price may be more appropriate for medium- to larger-scale operations. Smaller companies with minimal payroll complexities may find themselves paying more than they need for features they will not use. Further complicating this issue, some small business owners report limited satisfaction with ADP’s customer service, which can fluctuate in reliability.

Budget-Friendly Solutions: Payroll4Free and eSmart Paycheck

For small businesses that don’t require extensive payroll functionalities, both Payroll4Free and eSmart Paycheck present cost-effective options. Payroll4Free is positioned as one of the few software services that offers free payroll administration for companies with fewer than 25 employees. Even in this capacity, it includes federal, state, and local tax management, along with essential tax forms like W-2 and 1099. Payroll4Free also integrates direct deposit features and an employee self-service portal.

That said, Payroll4Free can only run on Windows systems, creating a limitation for businesses operating on other platforms. Furthermore, with its employee cap set at 25, larger companies would outgrow the platform as they grow.

Similarly, eSmart Paycheck is another low-cost solution helping businesses complete essential payroll tasks, such as tax calculation and pay stub printing. However, the software loses much of its utility after the initial three-month free period, where features such as tax deposit and e-filing become unavailable without a paid subscription. For businesses needing direct deposits and state tax filings, the post-trial limitations of the platform may warrant seeking alternative options. Nevertheless, for workplaces with minimal payroll or tax needs, both platforms offer value at little cost.

Enhancing Operational Efficiency with Integrated Features

The integration of payroll systems with other business functions offers substantial advantages, particularly for smaller organizations looking to optimize their operations. Applications like Homebase and Gusto exemplify how they package multiple functionalities, such as time tracking, scheduling, and communication. This integration streamlines workflow and minimizes errors that can arise from manual input or separate systems. By incorporating these features, businesses can enhance productivity and ensure their teams function efficiently. Additionally, such integrated solutions alleviate the administrative burden, allowing business owners to concentrate on growth and strategic initiatives.

Beyond basic payroll capabilities, several software options, including QuickBooks Payroll and OnPay, have expanded their offerings to support specific industry needs. For instance, OnPay tailors its services with tools such as minimum wage tip makeup, catering to sectors like restaurants that require specialized management. Moreover, Homebase includes functionalities like tip management and early wage access, further demonstrating the variety and depth of services provided. This comprehensive nature makes applications like these particularly beneficial for businesses seeking an all-encompassing approach to managing payroll for small business needs. By offering features that go beyond the standard payroll processing, such software solutions provide a valuable resource for effectively managing workforce requirements.